A Customer-Centric Approach to Boost Business Viability

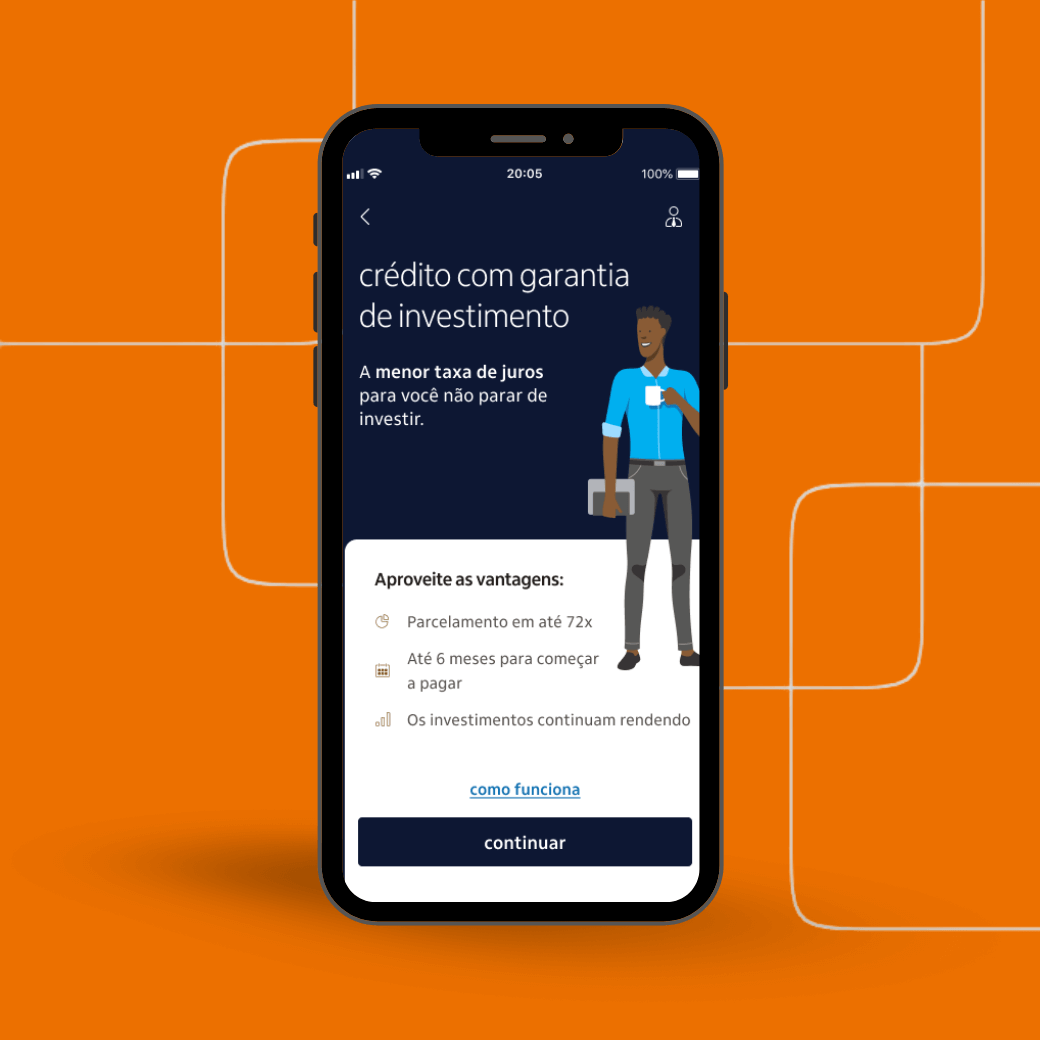

Itaú’s Investment Guarantee Credit (CGInvest) was introduced in response to post-pandemic market changes. Despite being an innovative solution, the product faced significant challenges, such as low adoption on mobile platforms, high interest rates, and unclear communication with clients. This context underscored the need to revisit CGInvest, improving usability, communication, and appeal to meet new economic conditions and user demands.

Itaú Unibanco

-

Project

Mobile Experience Review for Investment Guarantee Credit - 2023 (6 months)

-

My Role

Figma, Miro, Jira, Maze, Google Analytics, Office Suite, Teams

-

Tools

Figma, Miro, Jira, Maze, Google Analytics, Office Suite, Teams

-

Team

Credit Guarantee Squad, including a Product Manager, software engineers, front-end developers, QA, coordinators, and approximately 30 interdisciplinary collaborators.

About the Company

Itaú Unibanco is the largest private bank in Latin America, serving over 51 million clients in 21 countries.

My Contribution

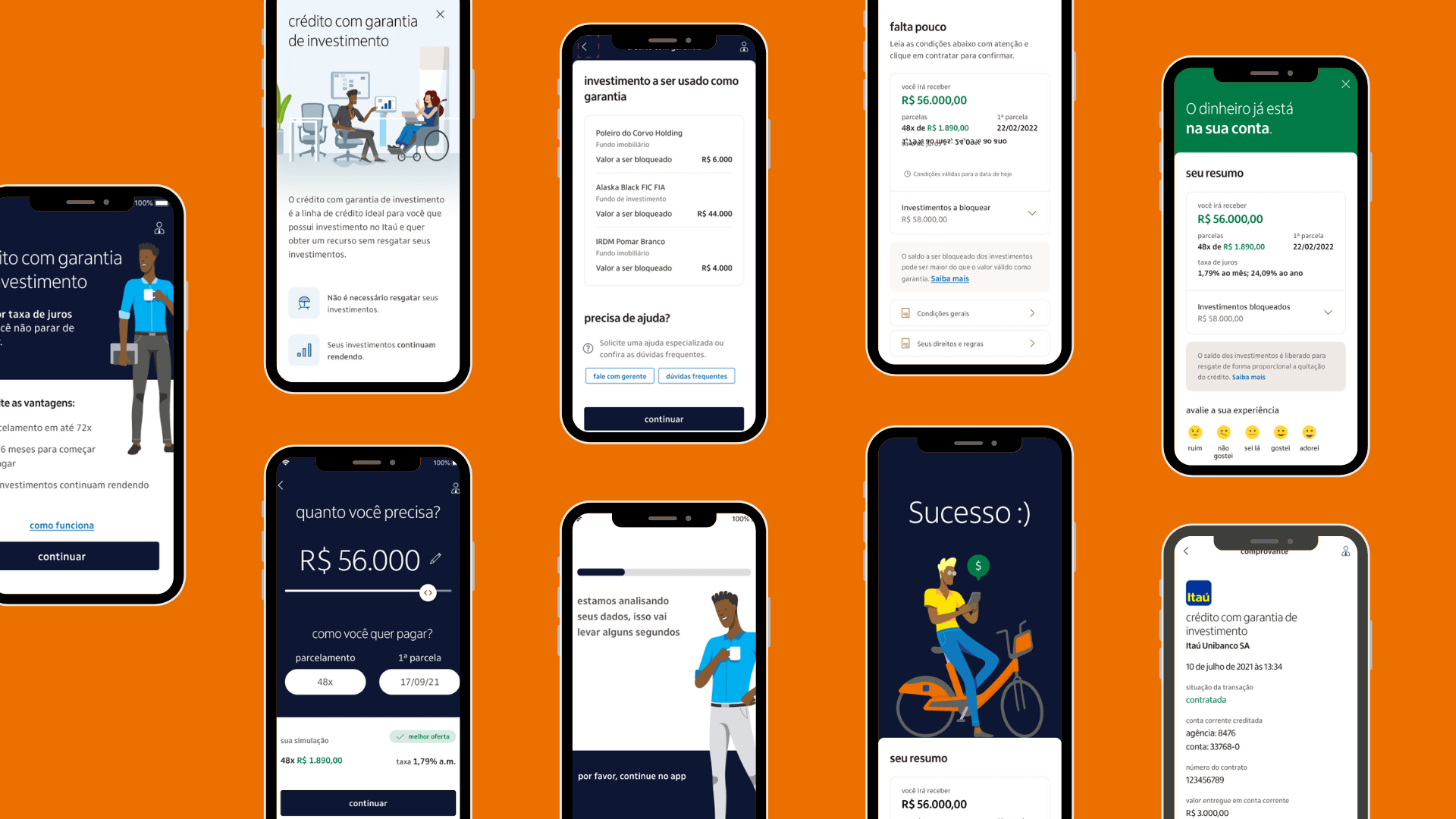

In this mobile project, I led the complete redesign of the CGInvest experience, working closely with senior leadership and the Product Manager. I created new components for the design system, adapted workflows for mobile interfaces, and led workshops to co-create client-centric solutions. I conducted usability tracking to ensure accessibility, including specific tests with blind users to evaluate navigation experiences with screen readers. Additionally, I developed and validated design solutions that prioritised inclusion, simplicity, and clarity for all user profiles.

Deliverables

User research, competitor analysis, persona identification, concept development, product improvement opportunities, metric analysis, journey mapping, mobile prototyping, visual design, new components for the design system, accessibility and usability tests.

Design Process

Empathise:

Data collection on clients and the market through research, metric analysis, and competitor benchmarking.

Define:

Hypothesis creation based on insights, exploring how clients perceive and use credit guarantee products.

Iterate:

Continuous validation and refinement of hypotheses to understand client needs and pain points.

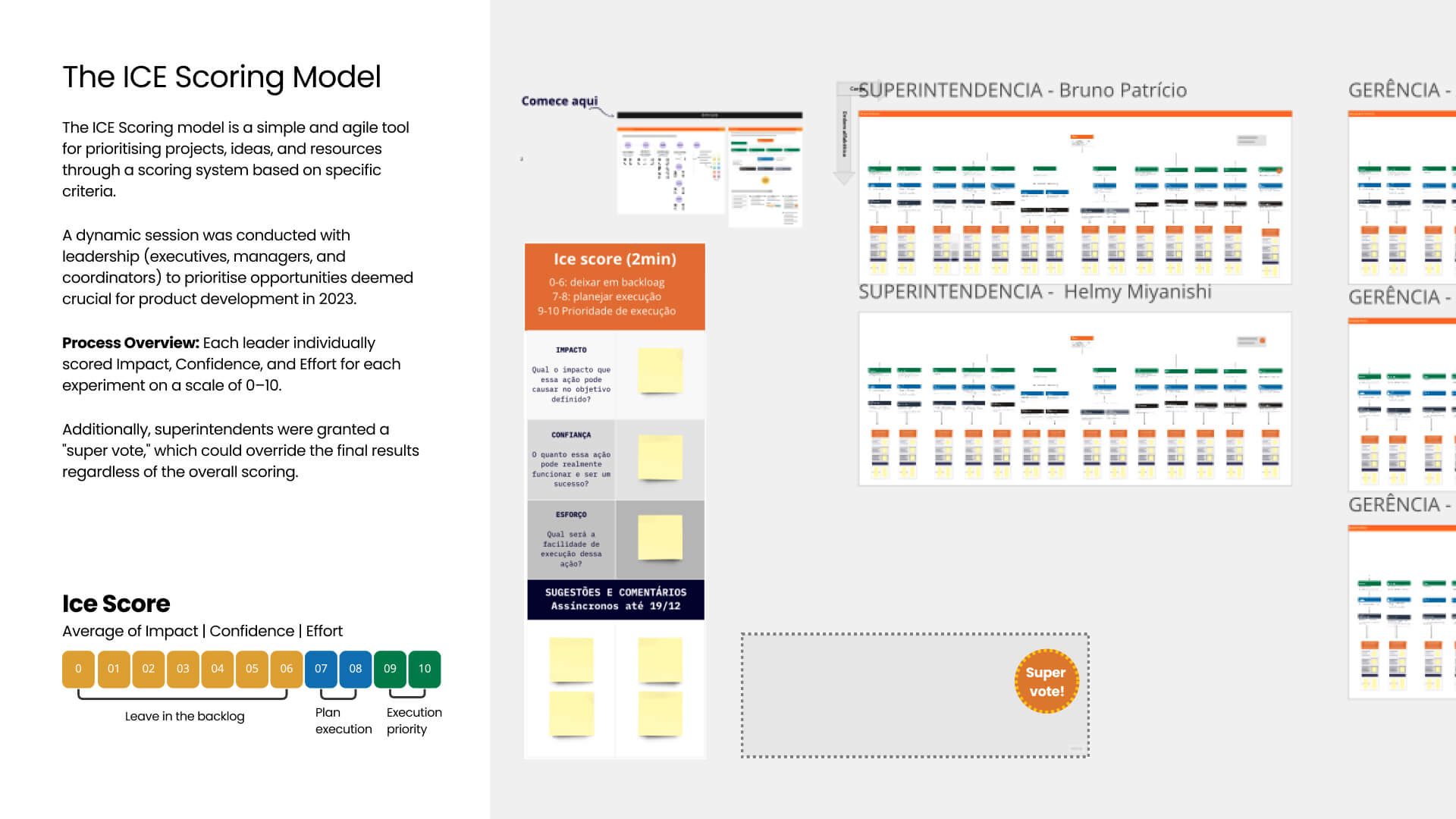

Ideation:

Conducted workshops and brainstorming sessions with stakeholders and technical teams to co-create value propositions.

Prototype:

Developed optimised workflows for mobile, interactive prototypes, and new design system components.

Validation (Continuous Discovery):

Ongoing usability tests using Maze, qualitative user feedback, and accessibility tracking with blind users utilising screen readers.

Challenges

-

Product Complexity: Rules linked to different investment types made it difficult for users to understand.

-

Mobile Usability: Navigation and design issues on the mobile interface hindered the user experience.

-

Lack of Clarity: The product’s communication was technical and unintuitive, discouraging users.

-

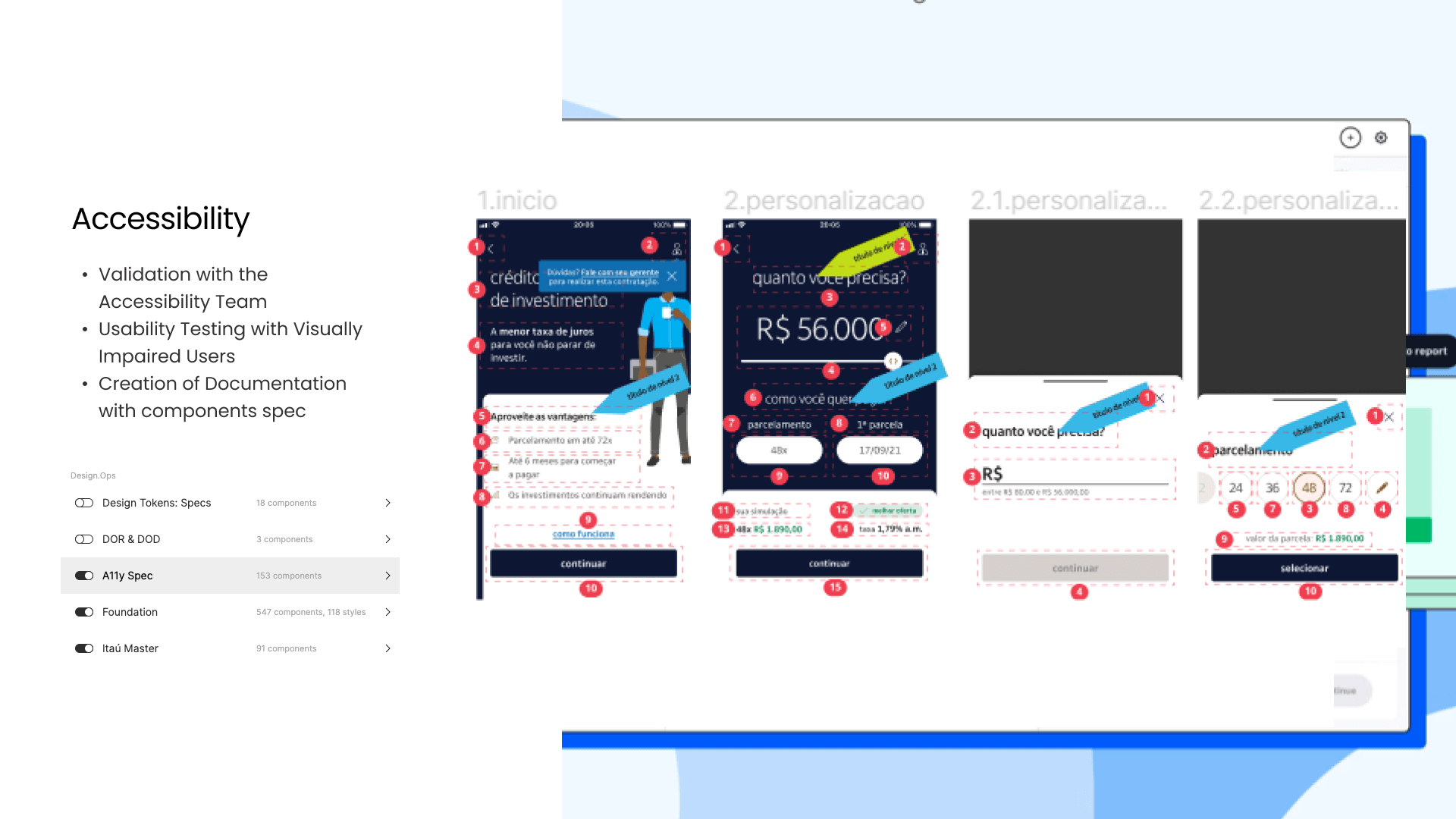

Accessibility: Ensuring the product was inclusive for visually impaired users.

-

Low Appeal: High interest rates and lack of flexibility in guarantees made the product less competitive.

-

Limited Visibility: The product had low priority among senior leadership due to underwhelming financial performance.

Insights

-

Simplification: Users needed a more intuitive interface to understand the product's rules and benefits.

-

Accessibility: Improved experiences for blind users by ensuring all functionalities were accessible via screen readers.

-

Clear Communication: Adjusting language to highlight benefits such as security and flexibility was essential.

-

Flexible Guarantees: Offering guarantees below 100% would enhance CGInvest's appeal.

-

Financial Education: Less market-savvy clients required educational approaches and specialised support.

Impact

The redesign of the CGInvest mobile experience went further, achieving a 37% increase in the conversion rate of the Investment Guarantee Credit funnel. This improvement was driven by simplified workflows, an intuitive interface, and clear communication that highlighted the product’s benefits. The creation of new components for the design system ensured visual consistency, scalability, and standardization for future updates.

Additionally, tests with blind users resulted in navigation improvements via screen readers, promoting inclusion and expanding audience reach. Research and workshops engaged the multidisciplinary team, strengthening internal alignment. This project highlighted the importance of client-centric design tailored to mobile interfaces, delivering an accessible, inclusive experience aligned with market needs.