Strategic Transformation in Customer Retention

The development of a Strategic Retention System was proposed to address the high cancellation rate in the first year of life insurance policies. The system aimed to automate the retention process and improve communication between physical stores, customer service centres, and brokers, using customer-focused data analysis and the CLV (Customer Lifetime Value) methodology to optimise service and strengthen the sales force with a more specialised approach.

MAG Seguros

-

Project

Insurtech Innovation Program - IMA (Intelligence Mongeral Aegon) Project - 2019 (Duration: 4 months)

-

My Role

Adobe XD, Illustrator, Photoshop, Trello, Office Suite, WhatsApp, Teams

-

Tools

Adobe XD, Illustrator, Photoshop, Trello, Office Suite, WhatsApp, Teams

-

Team

Business Intelligence from the commercial planning area and more than 50 interdisciplinary collaborators

About the Company

MAG Seguros, an insurance company under the Mongeral Aegon Group, with nearly 200 years of experience in life insurance and pensions.

My Contribution

As part of the Insurtech Innovation program, I contributed to several innovation fronts in the insurance area, engaging in everything from research and business planning to interface development, integrating teams from various MAG Seguros areas, such as Commercial Management, Products, Control Centre, Digital Marketing, Technology, Corporate Education, Operations, Customer Service, Data, and Intelligence.

Deliverables

User Research, Business Model, Concept Development, Information Architecture, Wireframing, Prototyping, Visual Design, MVP Concierge.

Design Process

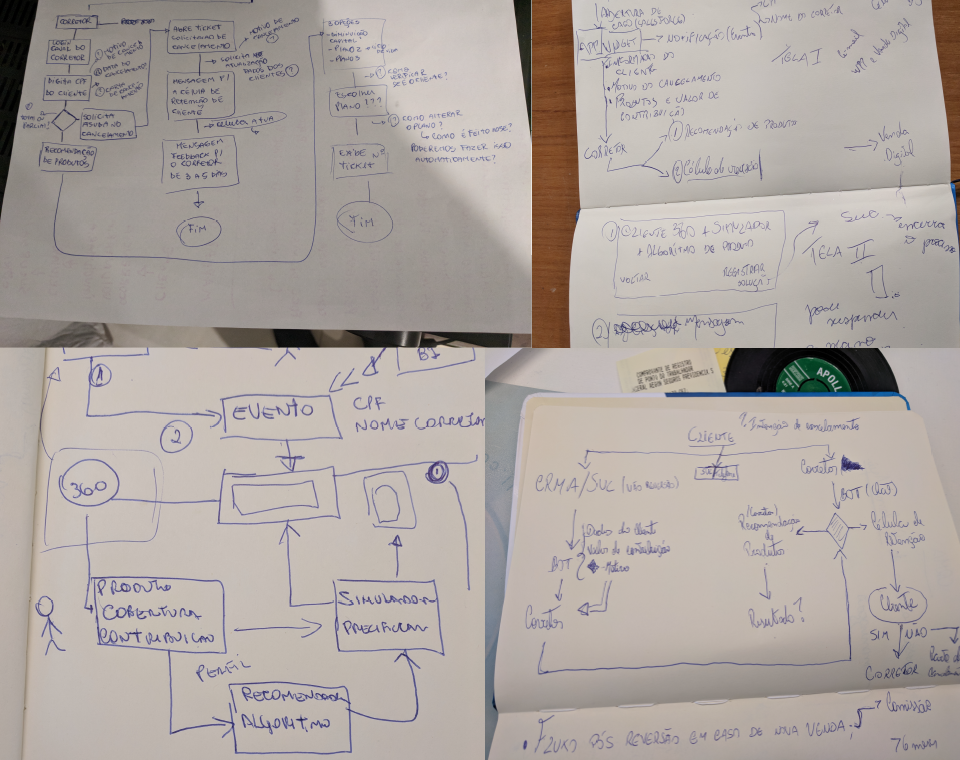

Empathise

Internal investigation and research into the insurance sector.

Define

Data analysis focusing on reducing cancellation rates.

Iterate

Qualitative and quantitative research to understand cancellation causes.

Ideation

Development of a new business model and OKRs definition.

Prototype

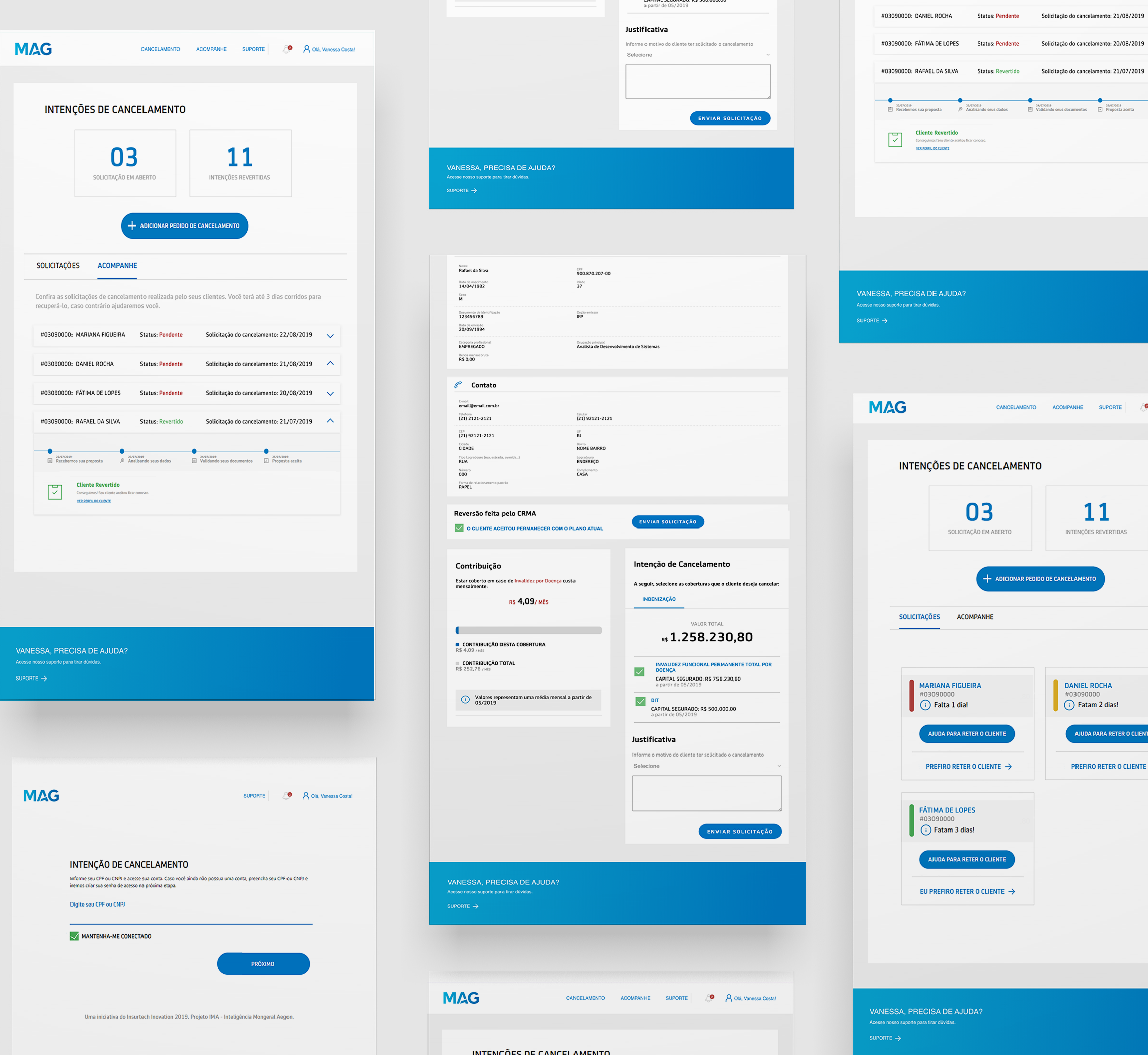

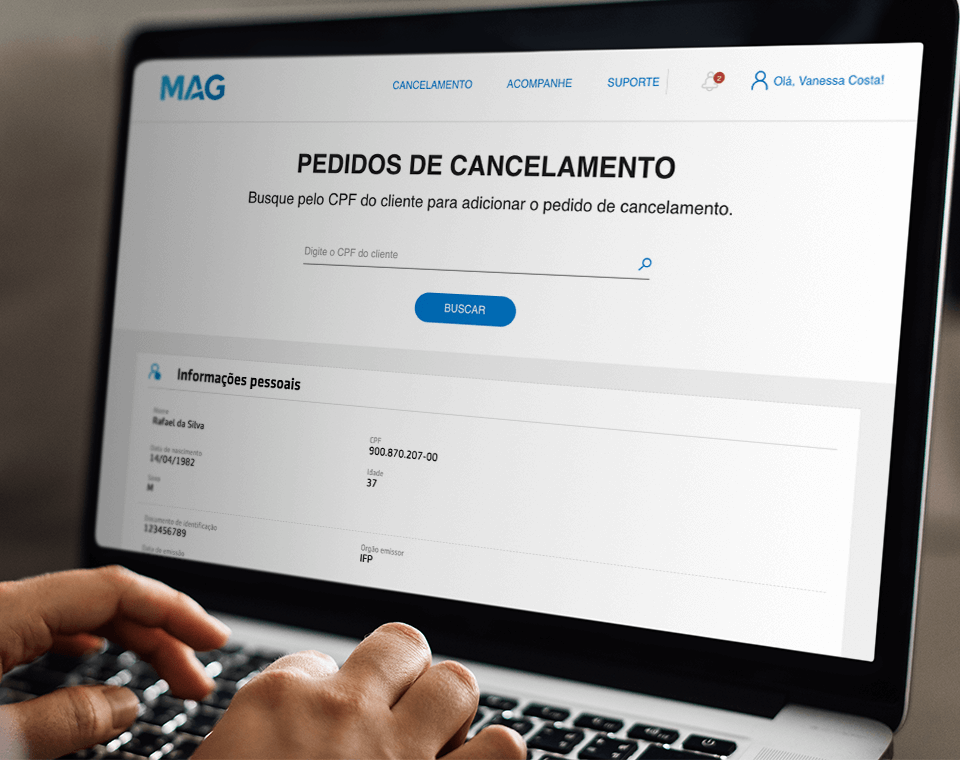

Creation of wireframes and prototypes.

Test

Validation of the business model and usability testing.

Challenges

-

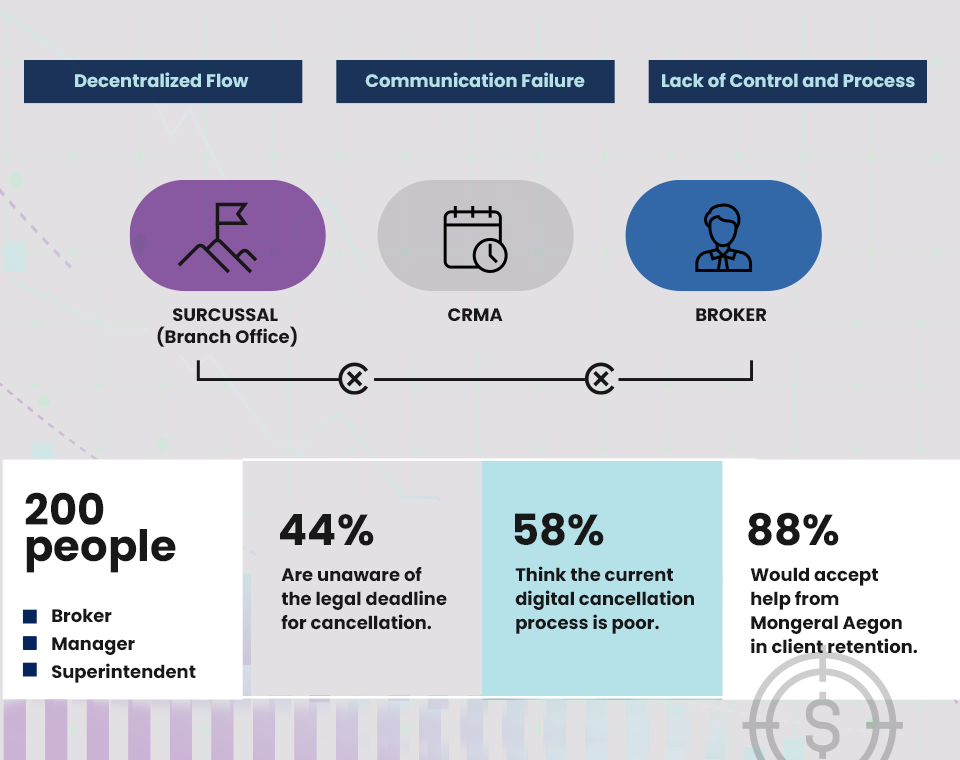

High cancellation rate in the first year of life insurance policies.

-

Legal processes for non-compliance with legally required cancellation deadlines.

-

Lack of systemic visibility to verify cancellation requests.

-

Decentralised cancellation flow.

-

High complaint rate, being in the top 5 in SAC and low NPS scores.

Insights

-

Decentralisation of information and lack of integrated systems impact decision-making in customer relationships.

-

Customer service centres couldn’t retain customers as they were tied to brokers, not the company.

-

Brokers often cancelled a customer’s product and activated another, leaving them uninsured for some time, which could cause issues if a claim occurred.

-

Contrary to company beliefs, brokers welcomed company support for customer retention.

-

Customers requested cancellations due to life cycle changes, financial difficulties, and poor sales practices.

MVP

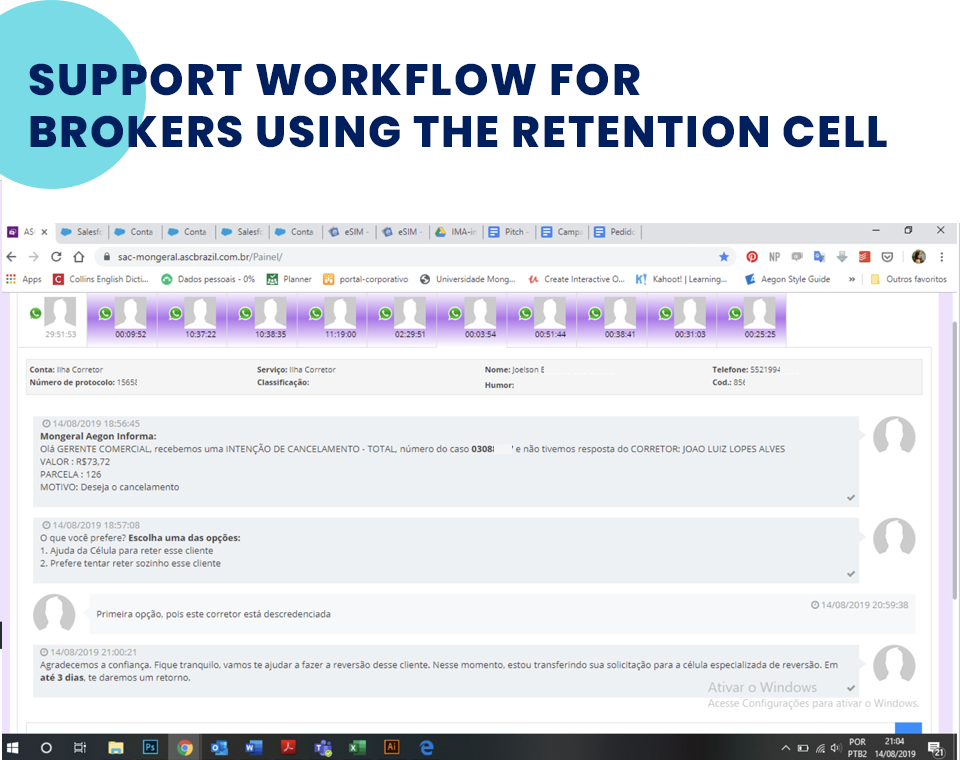

A test was conducted between 12 and 16 August 2020 with an MVP concierge, using WhatsApp for communication between brokers and the retention centre. Customers requesting cancellations were notified to brokers and commercial managers via a bot, offering retention support. The test revealed that 87% of brokers preferred company support, resulting in 38% retention of customers initially requesting cancellations.

Impact

The project drove a mindset change, revealing brokers’ need for support. The Strategic Retention System increased transparency, integrating brokers, physical stores, and customer service centres. The solution included automated notifications and machine learning-based sentiment analysis integration. This project stood out for its low cost and rapid implementation, culminating in winning an internal competition and a trip to visit Aegon’s headquarters in Amsterdam.