A Customer-Centric Approach to Boost Business Viability

Itaú Unibanco is the largest private bank in Latin America, serving over 51 million customers across 21 countries. This project focused on Investment Guarantee Credit (CGInvest), an investment credit guarantee product with low mobile adoption. The initiative aimed to improve customer understanding, accessibility and strategic clarity to validate long-term business viability. This product was introduced in response to post-pandemic market changes.

Itaú • Financial Services

-

Industry

Financial Services

-

Duration

2023 — 6 months

-

Tools

Figma, Miro, Jira, Maze, Google Analytics, Office Suite, Teams

-

Team

Credit Guarantee Squad with product, engineering, research, legal, business intelligence and leadership, involving more than 30 interdisciplinary collaborators

My Role

Digital Transformation (Strategic Designer, UX/UI Designer, Service Designer, Facilitation, UX Researcher)

Problem

This project was complex, difficult to understand and hard to trust on mobile. Accessibility gaps and unclear communication limited adoption, while leadership lacked evidence of market potential to justify further investment.

Outcome

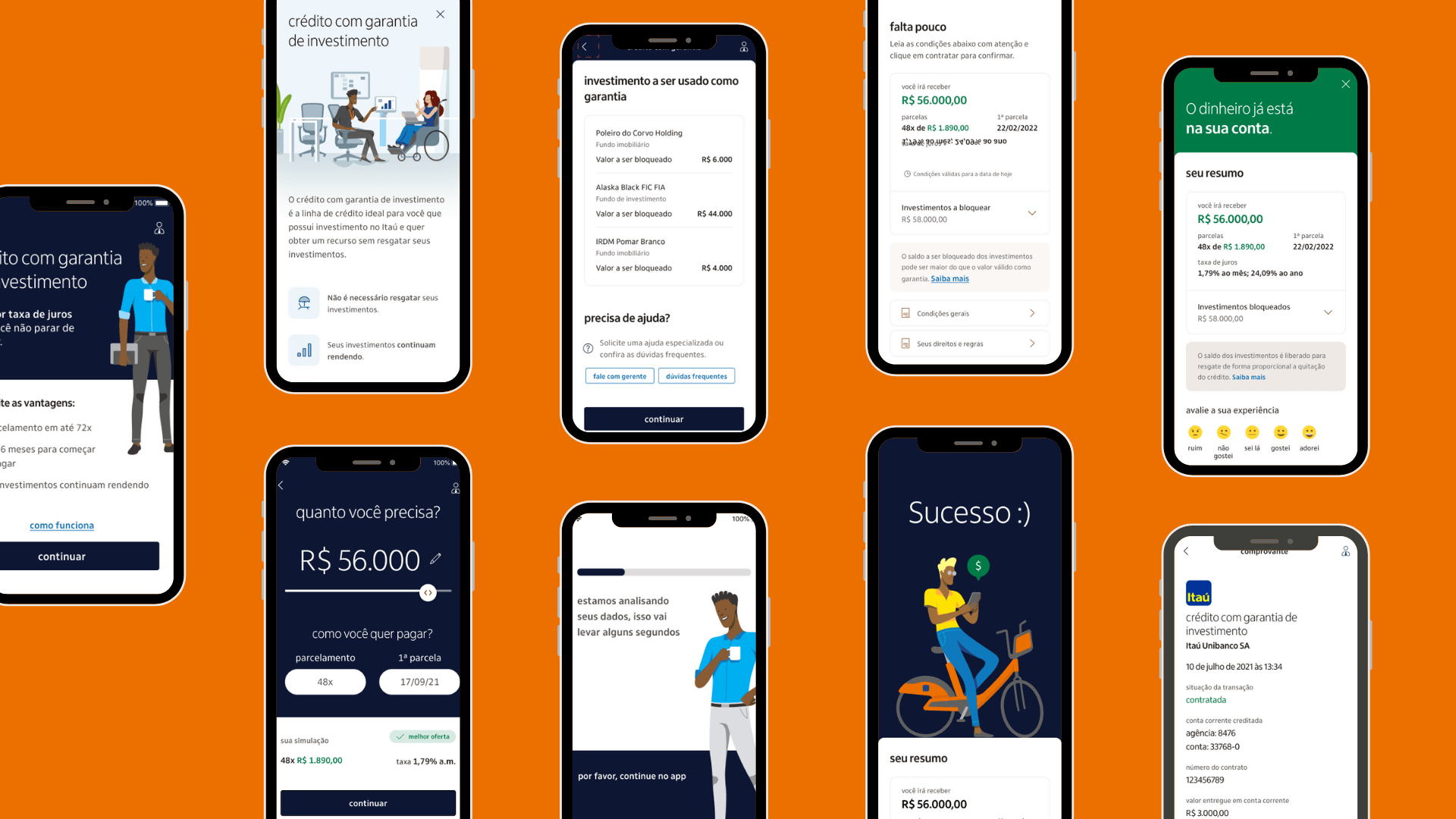

Investment Guarantee Credit from a complex financial feature into a clearer end-to-end service. By aligning customer needs, internal processes and strategic goals, the redesigned mobile experience increased conversion by 37 percent and supported Itaú’s broader digital transformation efforts.

Design Process

Qualitative and quantitative research was conducted, analysing internal documents, interviewing clients and benchmarking competitors to identify behavioural patterns and opportunities.

Product hypotheses were generated, clustered into strategic themes and prioritised using an Opportunity Tree aligned with user needs and business goals.

Workshops with leadership and cross-functional teams aligned priorities and strengthened strategic clarity.

Optimised mobile workflows, interactive prototypes, and new design system components.

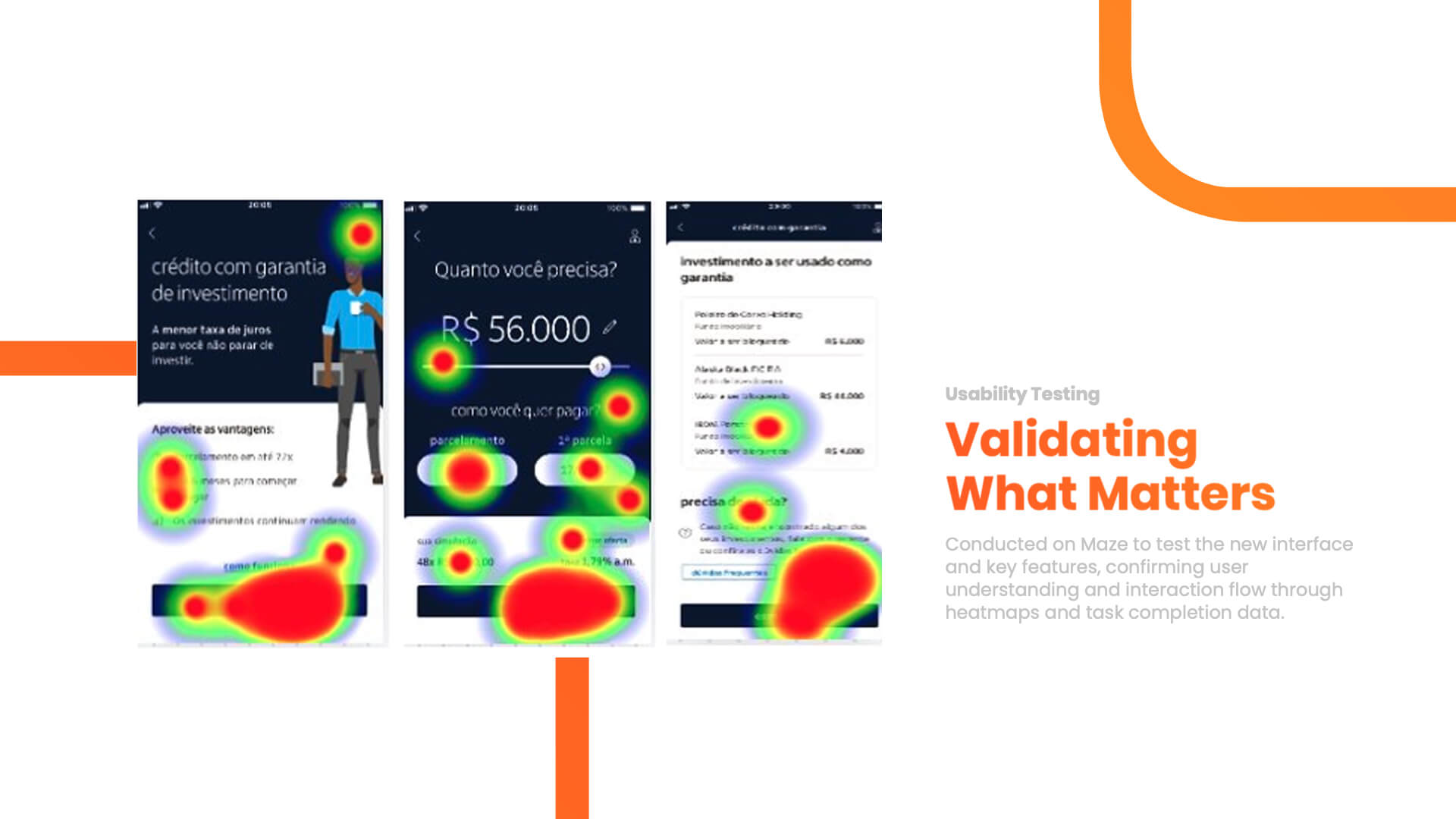

Ongoing usability tests (Maze), qualitative feedback, and accessibility tracking with blind users using screen readers.

Challenges

Product Complexity: Rules linked to different investment types made it difficult for users to understand.

Low mobile usability

Need to prove market potential

Accessibility for visually impaired users

Market constraints and competitiveness

Key Insights

Simplification: Users needed a more intuitive interface to understand the product's rules and benefits.

Improved experiences for blind users by ensuring all functionalities were accessible via screen readers.

Clear communication drives adoption

Flexibility increases perceived value

Financial Education: Less market-savvy clients required educational approaches and specialised support.

Continuous discovery supports strategic alignment

Results and Reflections

This project showed how service design can drive digital transformation beyond interfaces. The 37 percent conversion increase reflected not only better usability, but clearer service logic and alignment across teams.

By connecting customer insights with strategic and operational decisions, Investment Guarantee Credit was repositioned as a scalable service within the bank. Key learnings included the importance of clear communication, inclusive design and system-level consistency to simplify complex financial products and support long-term evolution.

Additionally, tests with blind users resulted in navigation improvements via screen readers, promoting inclusion and expanding audience reach.